A few things about me that are relevant:

First, I’ve recently come to believe that the single most important skill for an individual living today (especially in the U.S.) is personal finance. The basic premise of this is to spend less than you make (only possible using a budget or jedi mind tricks) and to save, invest, and give the difference.

Also, I love data and data visualization. I love to do analysis, make charts, build tools and dashboards. My personal finance dashboard (to be released soon), would make any CFO cry with delight. It has been the tool with which I have been able to rocket to financial security from financial rock bottom.

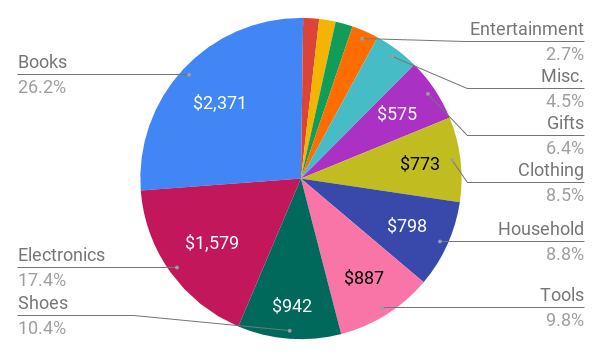

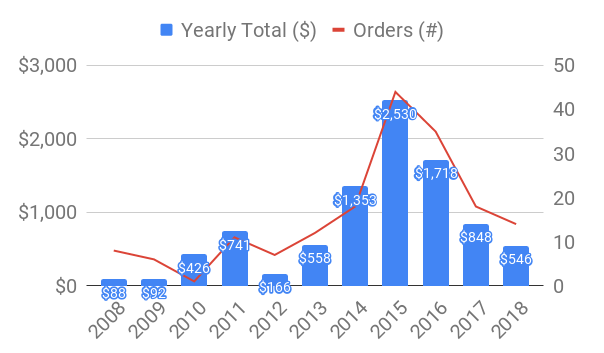

During this journey, I realized I could easily look at online shopping data (simply copying and pasting my past orders into a google sheet and working my magic).

Diligent readers of mine know I am a “Tidier” (Marie Kondo follower) and a “Baby-stepper” (Dave Ramsey follower).

What’s most interesting is the precipitous drop in online spending (and speeding in general) once we started using a budget (right around mid-2016) and stopped spending 96% – 107% of our income. Thank God for budgeting.

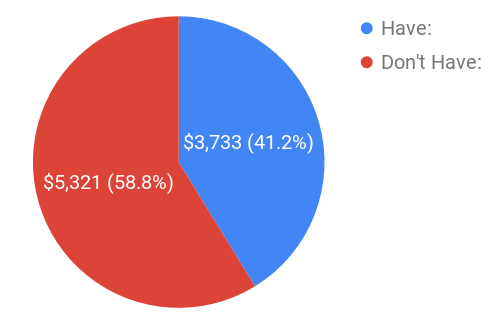

Most of the stuff I don’t even have anymore!

Literally $5,300 of online crap that isn’t even around anymore. Talk about throwing money away.

I couldn’t be happier that I’ve changed almost all of my money and living habits in the last few years!

Hope you found this interesting!

You may also like:

PS – A few notes on the above:

- I did this analysis in 2019, about two solid years into the Baby Steps process. At that point I had a lot of experience crunching numbers, etc.

- It’s 2020 right now, which makes it easier to publish personal/financial information.

- I haven’t run this analysis since 2019, so I probably have even less of this stuff having tidied a few times since then.

- I’m not against online shopping (in fact, I love it), but I’m mostly promoting budgeting, using data, and taking control of your financial destiny (which is 90% behavior and mostly dependent on spending habits, which are by nature, invisible unless you’re really look into them, keep track, or are budgeting).

- If you’re interested in getting your personal finances in order, read one (or all) of the following books (in this order) (Affiliate Links): Total Money Makeover, Your Money or Your Life, Unshakeable.